Key Takeaways

As the life insurance industry evolves, client needs do too. The demand for life insurance products that can be bought and sold digitally, with a personalized purchasing experience, continues to increase year after year.

Insurtech company Quility is leading the charge in the digital space, creating proprietary life insurance products that meet the growing demand for a virtual buying experience. From flexible coverage amounts and limited underwriting to unique riders and an effortless, online application process, Quility’s digital products are reshaping how life insurance is bought and sold.

Subsidiary of Quility, Symmetry Financial Group, hosts a nationwide network of life insurance agents who have access to Quility’s digital products and platforms to help serve their clients., pulvinar dapibus leo.

A future full of digital products

The current state of life insurance (as it is for most industries) hinges on meeting the client in a digital space. From initial outreach and lead generation to underwriting, the life insurance market is fighting for the attention of a clientele that prefers virtual shopping and digital receipts.

It is no longer a question of whether a successful life insurance business will meet those needs. It’s a matter of whether they can provide clients with a unique (digital) buying experience while fitting them with coverage that is as customizable as possible.

When you aren’t adapting to the rapid evolution of your client’s needs, it’s easy to find yourself in the wake of someone who did. It’s unlikely that the trend of online life insurance will slow down any time soon, and understanding how to sell digital products and thrive in digital platforms will be the key to harnessing the future of life insurance.

The life insurance market is fighting for the attention of a clientele that prefers virtual shopping and digital receipts.

Life insurance purchasing experience – make it personalized

Creating a memorable purchasing experience for the client is paramount to the success of the sale. If your client can expect similar results in a sea of online promises, it’s essential that you highlight the value of a personalized buying process and follow through.

Thanks to digital applications and products, a lot of that personalization comes more naturally than one might realize. Regular data collection is more easily obtained with online applications, so everything from applying to underwriting can be done more effectively.

Taking the temperature of the industry

In 2023, client needs are changing and understanding what those changes are (and more importantly what’s fueling them) is a critical piece to the overall puzzle.

Most of what’s driving the modern appetite for life insurance stems from a demand for more financial literacy. Younger generations (and consumers) are leveraging social media for financial information.

As evidence of this, the social platform TikTok saw over 500 million views on videos that were tagged as “#FinTok.” As these digital-forward generations become more financially literate, a demand for digital financial purchases is becoming more prevalent. Leaning into that demand and evolving to both provide more financial education to clients and offer a completely virtual buying experience should be priority number one for insurance agents.

In 2023, the number of women who need life insurance increased. Workforce participation rates between men and women are the narrowest they’ve ever been with men making up 68.2% and women at 57.7%. While this is only a small jump from numbers in 2022, this trend is sure to keep rising. With more women making up the nation’s workforce, more women need life insurance; it’s important to keep this message at the forefront when you reach out to prospective clients.

LIMRA Barometer Study

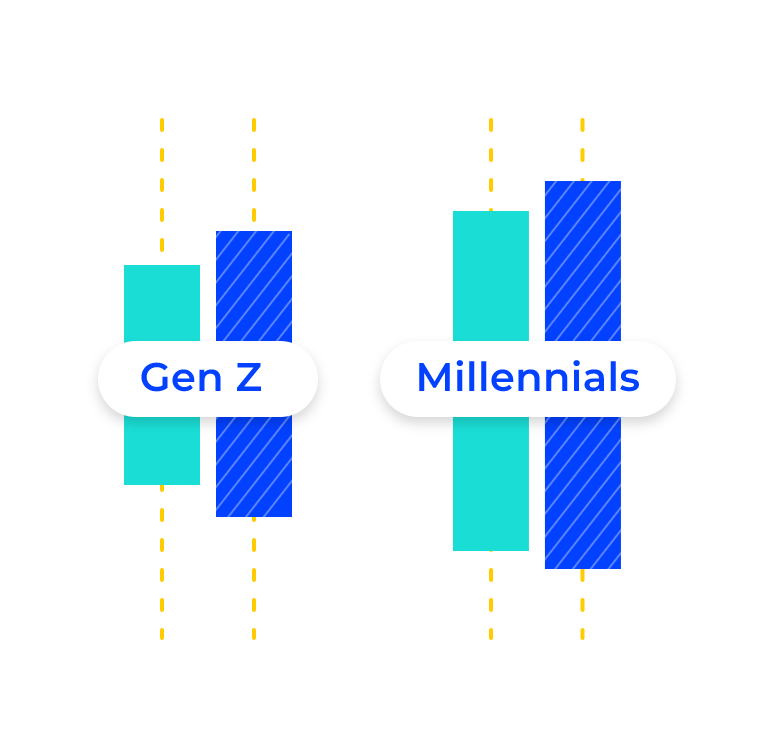

Life insurance research company, LIMRA (Life Insurance Marketing and Research Association), released their 2023 Barometer Study alongside life insurance non-profit Life Happens to better understand the financial needs and priorities of Americans. With growing insurance ownership among Gen Z and Millennials, they spent a lot of their focus on understanding the life insurance needs of younger adults in the U.S.

Just between 2022 and 2023, life insurance ownership among Gen Z grew from 34 to 40% and from 45 to 48% among Millennials. Still, that leaves a wide net of potential customers with approximately 48% of U.S. adults completely uninsured. The Barometer Study also found that 53 million individuals in either generation believed they had insufficient life insurance coverage.

Life insurance ownership among Gen Z grew from 34 to 40% and from 45 to 48% among Millennials

Source: LIMRA

In their study, LIMRA discovered an interesting myth among both Gen Z and Millennials. The study found a chief reason for not having life insurance was a belief that it was too expensive. Gen Z also claimed their biggest reason for not having life insurance was, “they just haven’t gotten around to it.” The cost of life insurance and the idea that it’s only meant for older customers are two misconceptions that the life insurance industry hopes to clear up.

Another finding from the 2023 Barometer Study was the importance of an online experience. To little surprise, LIMRA also found that both Millennials and Gen Z preferred an online purchase when shopping for life insurance.

Both Millennials and Gen Z prefer an online experience when shopping for life insurance.

Quility digital products

Quility understands the importance of reimagining the future of life insurance and aims to make the purchasing and sales experience as frictionless as possible. Beyond that, Quility’s digital life insurance products are designed to meet the needs of an ever-evolving client base.

Quility supports a nationwide network of life insurance agents through its subsidiary, Symmetry Financial Group, providing direct-to-consumer strategies to support the agent through the sales process. Starting with our value-based leads system, Symmetry agents can purchase leads through the Quility Leads Marketplace that are designed to give them a high return on investment.

The leads are priced to deliver a value that matches their investment, and with several lead types and sources, there’s something for every agent, regardless of their experience in the field. The leads are then seamlessly delivered to Symmetry agents through Switchboard, the automation engagement platform that allows them to do everything from creating personalized campaign funnels to automating client outreach. Switchboard is a centralized location for all lead information and nurtures the prospective client with automated outbound emails, calls and texts.

Quility’s proprietary, digital products have been impactful in the insurance industry and boons to both Symmetry agents and their clients. These digital products are affordable, personalized and easy to apply and qualify for. Alongside digital platforms where clients can purchase policies and Symmetry agents can sell them, Quility’s digital lead portfolio is growing evidence of innovation in the life insurance industry.

Quility Level Term

Quility Level Term (QLT) was the first of many efforts by Quility to create a supply for the increasing demand for digital products. In collaboration with SBLI (The Savings Bank Mutual Life Insurance Company of Massachusetts), Quility created this instant-decision term life policy with an entirely digital application process.

This guaranteed term life policy is an affordable (and adaptable) response to clients looking for a more personalized and virtual buying experience. With term lengths up to 30 years ranging from $100,000 to one million dollars in coverage, QLT was designed to appeal to generations of life insurance clients who either didn’t think they could afford life insurance or didn’t realize it was time to invest.

More than that, QLT boasts a set of unique policy riders that allows clients to further customize their coverage and address what matters most for their financial goals. QLT also offers clients flexible term lengths from 10 to 30-year terms, so they can secure coverage for the length of time that makes the most sense.

Quility Term Plus

Building off the momentum of QLT, Quility created its next installation in the digital product space — Quility Term Plus (QTP). Supported by Legal & General, QTP is a renewable term life policy with even more flexible term lengths. While most term life coverage works in intervals of 10, QTP offers clients a more exact term length with intervals of five between 10 and 40-year terms.

With a max face coverage amount of two million dollars, Quility Term Plus is true to its name by offering even more flexibility for clients. QTP also offers an accelerated death benefit that allows policyholders to collect on a death benefit in the event of a qualifying terminal illness.

Quility Secure Future Preferred

Quility’s proprietary product suite doesn’t just include term life; next up is an instant-issue final expense whole life policy with the help of American-Amicable Life Insurance Company of Texas — Quility Secure Future Preferred (QSFP).

This policy can be applied for and issued in less than 10 minutes, making it one of the most accessible (and simplest) final expense products in the life insurance industry. Unlike traditional final expense policies, Quility Secure Future Preferred is targeted for healthier clients between the ages of 50 and 85 who want a higher amount of permanent coverage.

Quility Secure Future Preferred

Quility’s digital products are providing real benefits to clients across the country. Whether that’s giving them an easy-to-use application process or pairing them with licensed agents with Symmetry, they’re helping families protect what matters most with products that make the most sense.

Quility clients also have a lot to say when it comes to working with Symmetry agents.

Charitable giving rider

Clients that purchase products from Quility are given more than a few reasons to be thankful. The charitable giving rider lets policyholders pay their gratitude forward using their policy.

This unique rider is automatically included with Quility digital products at no extra charge. It gives the insured the choice to add their favorite non-profit as a secondary beneficiary on their policy. A tax-free contribution via a death benefit is an appealing added value to Quility’s clientele.

Quote and sell life insurance with Quility Navigator

Quility’s agent force, through Symmetry Financial Group, is supported by more than just proprietary products. Quility has invested in platforms that enhance those products and the agent’s ability to help their clients more effectively. In July of 2023, Quility announced the launch of Quility Navigator, a platform designed to eliminate the friction of buying and selling life insurance.

Navigator is a free, user-friendly platform that acts as a one-stop site for agents to quote and sell Quility’s digital products.

Through Navigator, Symmetry agents have access to a product selector and quoter tools that help agents confidently pair their clients with the best-fit product and look for additional ways to cover them and meet their unique financial goals.

As Quility’s proprietary, end-to-end digital life insurance distribution marketplace, Navigator makes quoting and selling life insurance easier than ever for Symmetry agents. Alongside the growing suite of Quility’s digital products, Navigator is a shining example of what insurtech is capable of.

Leverage Quility digital products

As the life insurance industry continues to evolve, it’s critical that client needs help steer innovation. Whether that’s products that more accurately meet the client’s unique needs or a purchasing process that allows them to quickly find and apply for coverage, Quility is constantly building onto that innovation.

As a Symmetry agent, you will have access to high-quality life insurance, disability income insurance, critical illness insurance, and annuity products from more than 30 well-known insurance companies. This gives you the flexibility and reach you need to tailor plans to meet clients’ individual coverage needs.

To learn more about how to begin a fulfilling career as a life insurance agent, contact us today.

About the Author

Read More Whitepapers

Citations

Hale, Jamie. “Council Post: Why the Time for Digital Life Insurance Is Now.” Forbes, 17 Apr. 2022, www.forbes.com/sites/forbesbusinesscouncil/2022/08/17/why-the-time-for-digital-life-insurance-is-now/?sh=1c78cc6426c4. Accessed 5 Oct. 2023.

Insurance, Quility. “Quility Launches Fully Digital Term Life Product, Quility Level Term, in Collaboration with SBLI and Afficiency.” www.prnewswire.com, 21 Sept. 2021, www.prnewswire.com/news-releases/quility-launches-fully-digital-term-life-product-quility-level-term-in-collaboration-with-sbli-and-afficiency-301381728.html?tc=eml_cleartime. Accessed 5 Oct. 2023.

Liebergall, Molly. “The US Hit Its Smallest-Ever Workplace Gender Gap.” Morning Brew, 6 Sept. 2023, www.morningbrew.com/daily/stories/2023/09/06/the-us-hit-its-smallest-ever-workplace-gender-gapmbcid=32628630.2458151&mid=f459cf63adb1562cf5d032a51953bb7b&utm_campaign=mb&utm_medium=newsletter&utm_source=morning_brew. Accessed 5 Oct. 2023.

Quility. “Quility Eliminates the Friction of Buying and Selling Life Insurance with Launch of Navigator.” www.prnewswire.com, 5 July 2023, www.prnewswire.com/news-releases/quility-eliminates-the-friction-of-buying-and-selling-life-insurance-with-launch-of-navigator-301870203.html?tc=eml_cleartime. Accessed 5 Oct. 2023.

Wood, Stephen . “LIMRA and LOMA – Securing the Future – Life Insurance Needs of Younger Adults.” Info.limra.com, 6 Sept. 2023, info.limra.com/gen-zy-barometer. Accessed 5 Oct. 2023.